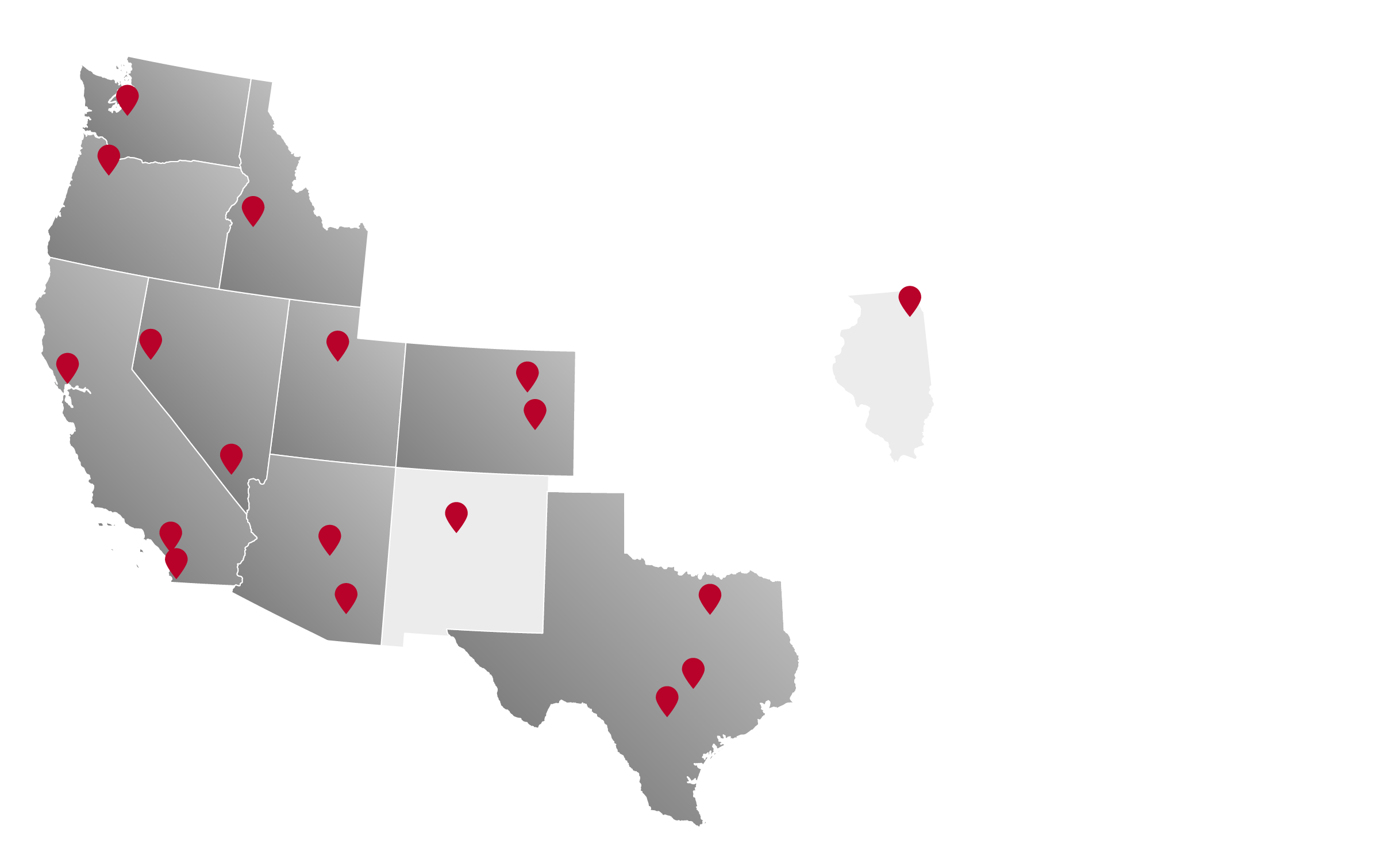

RedHill invests nationally, but most heavily in the Western United States and analyzes more than $1 Billion in market and off market offerings every week. RedHill has "boots on the ground" and significant channels in place to originate, to underwrite and to execute deals. The firm has immediate access to market intelligence and market channels beyond other competitors, and is experienced in adding value through problem solving, structured finance, and management efficiency.

Regional scope

C+ to B quality

Vintage scope 1990-2000

Middle-market

Workforce housing

60-70% leverage

Cash flow and stabilized

Hold 3-5 years

Intense interior and exterior renovations

Focused property management

Highest risk adjusted returns to investor

Regional scope

B+ to A- quality

Vintage 2010 or newer

Quality core-plus

Target metro regions

60-65% leverage

Cash flows and stabilized

Hold 5-10 years

Light interior and exterior renovations

Focused asset management

Moderately low risk and return threshold

Seeking 14-16% returns+

Will acquire Core under Separate Account Mandates

National scope

Market distress opportunities

Portfolio acquisitions

Asset recapitalizations

Comprehensive finance solutions

Debt or Preferred Equity

GP venture formation

Development co ventures

High risk, high yield spectrum

Third-party property and asset management

Portfolio acquisitions

Trade originations and facilitation

Development and construction management

Valuation, underwriting and consultation

We are focused on Client driven Risk adjusted Return thresholds.